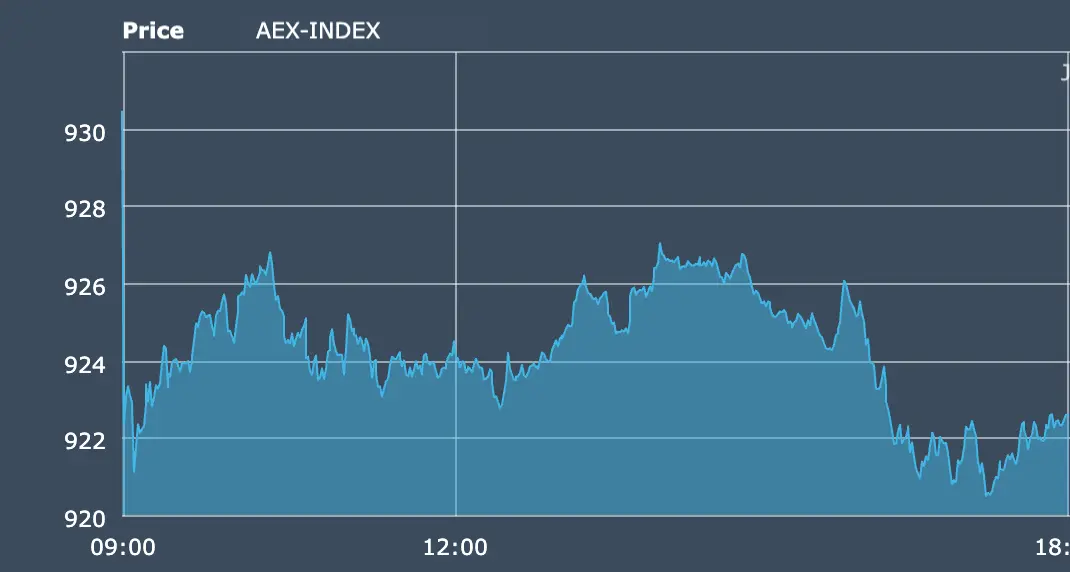

On June 13, 2025, the AEX Index closed at 922.62, down 7.86 points or 0.84%. This decline reflects a market grappling with heightened geopolitical tensions and economic uncertainties.

Movement and Meaning

The day began with a sharp drop in the AEX, influenced by Israel's recent airstrikes on Iranian nuclear facilities, which escalated tensions in the Middle East. This conflict has led to a significant surge in oil prices, with Brent crude rising over 10% at one point, marking its biggest daily gain since April 2023 . The spike in oil prices raises concerns about potential stagflationary shocks, as rising energy costs could fuel inflation while dampening economic growth.

Additionally, the ongoing trade tensions between the U.S. and China continue to unsettle global markets. The Netherlands, with its open economy and significant trade relationships, is particularly vulnerable to these developments. The Dutch central bank (DNB) has warned that a full-blown trade war could reduce the country's economic growth to 0.4% by 2026, down from the projected 1.5%, and increase inflation by nearly 0.5 percentage points .

What to Pay Attention To

Investors should monitor the bond market, as yields have been volatile amid these global tensions. The energy sector may experience fluctuations due to potential disruptions in oil supply from the Middle East. Furthermore, the ongoing U.S.-China trade negotiations could impact export-oriented companies, depending on the final terms of the agreement.

Entrepreneur-Oriented Takeaway

For Dutch entrepreneurs and small business leaders, today's market behavior underscores the importance of agility and resilience. Geopolitical events and international trade dynamics can have swift and significant impacts on local markets. Staying informed and adaptable is crucial in navigating these uncertainties.

Closing Insight

In times of global uncertainty, markets often reflect the collective apprehension of investors. As business leaders, it's imperative to remain vigilant, informed, and prepared to adapt strategies in response to evolving geopolitical and economic landscapes.

Co-Founder of Xtroverso | Head of Global GRC

Paolo Maria Pavan è la mente strutturale dietro Xtroverso, unendo la competenza nel compliance alla visione strategica dell’imprenditore. Osserva i mercati non come un trader, ma come un lettore di schemi—tracciando comportamenti, rischi e distorsioni per guidare una trasformazione etica. Il suo lavoro sfida le convenzioni e ridefinisce la governance come forza di chiarezza, fiducia ed evoluzione.