The Amsterdam AEX Index closed on June 9, 2025, at 932.11, marking a modest gain of 0.23% from the previous session. This subtle uptick reflects a market mood that is cautiously optimistic, with investors displaying a measured confidence amid a backdrop of global economic uncertainties.

Movement and Meaning

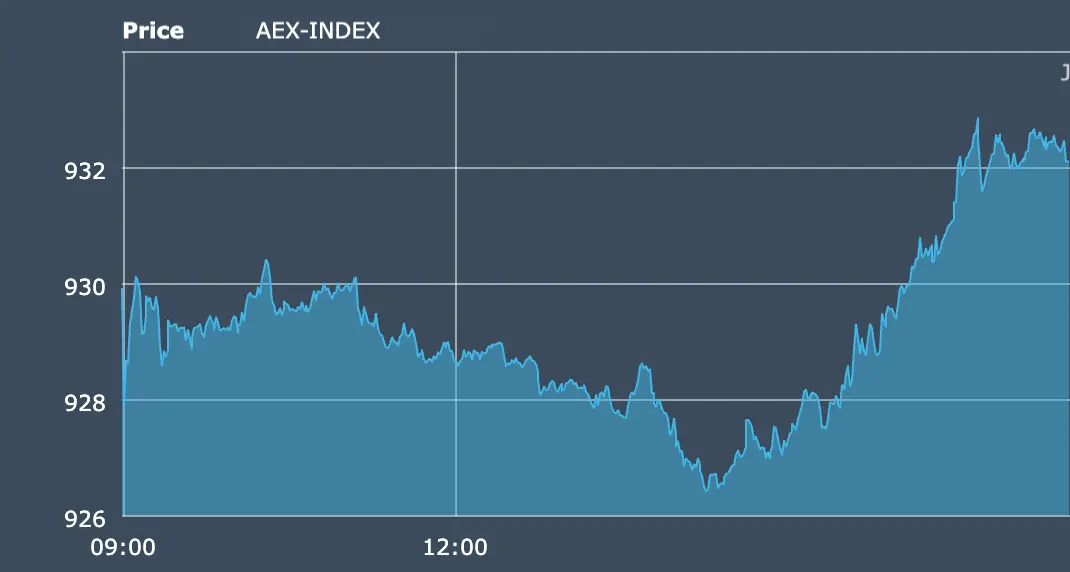

Today's trading session was characterized by a steady climb, with the AEX Index opening at 927.74 and reaching an intraday high of 932.86 before settling at 932.11. The day's range was relatively narrow, indicating a lack of significant volatility. This stability suggests that investors are maintaining a watchful eye on macroeconomic indicators, awaiting clearer signals before making substantial moves.

Signals Worth Noticing

One notable development is the performance of the technology sector, which showed resilience despite broader market hesitations. Companies like ASML Holding and Prosus contributed positively to the index, hinting at sustained investor interest in tech-driven growth. Conversely, the energy sector remained flat, reflecting ongoing concerns about global demand and pricing pressures.

On the macroeconomic front, the market's subdued reaction suggests that investors are digesting recent data releases and geopolitical developments with caution. The anticipation of upcoming central bank meetings and policy announcements is likely contributing to the current holding pattern.

Global Events Influencing Market Sentiment

Several international developments on this day had the potential to impact investor confidence:

- Los Angeles Protests and Federal Response: In the United States, President Donald Trump deployed 2,000 National Guard troops to Los Angeles without the consent of California Governor Gavin Newsom, following escalating protests against aggressive immigration enforcement operations. The protests, which included the setting of self-driving cars on fire and clashes with law enforcement, raised concerns about civil unrest and federal overreach, potentially unsettling investors wary of political instability in a major global economy.

- Russia's Massive Drone Attack on Ukraine: Russia launched its largest drone assault since the beginning of the war, deploying nearly 500 drones and missiles across Ukraine. While most were intercepted, the sheer scale of the attack, coupled with NATO's response of scrambling fighter jets over Poland, signaled a significant escalation in the conflict. Such developments may have heightened geopolitical tensions, influencing investor sentiment in European markets.

Implications for Dutch Entrepreneurs and Small Businesses

For Dutch entrepreneurs and small business leaders, these events underscore the importance of strategic vigilance. The AEX's stability amid global unrest suggests a resilient domestic market, but the international landscape remains volatile. Businesses should consider diversifying supply chains, staying informed about geopolitical developments, and preparing contingency plans to navigate potential disruptions.

Closing Insight

In times of global uncertainty, the steadiness of local markets offers a semblance of reassurance. However, true resilience lies in proactive governance and ethical foresight. As external forces challenge the status quo, Dutch enterprises must balance confidence with caution, ensuring that their foundations are robust enough to withstand the tremors of a shifting world order.

Co-Founder of Xtroverso | Head of Global GRC

Paolo Maria Pavan es la mente estructural detrás de Xtroverso, combinando el rigor del compliance con la visión estratégica del emprendimiento. Observa los mercados no como un trader, sino como un lector de patrones—rastreando comportamientos, riesgos y distorsiones para orientar una transformación ética. Su trabajo desafía convenciones y redefine la gobernanza como una fuerza de claridad, confianza y evolución.