As a freelancer in the European Union, you're part of a growing workforce that's reshaping the business landscape. Your independence allows for flexibility and creativity, but it also comes with its own set of challenges – particularly when it comes to compliance.

At Xtroverso, we understand these hurdles and are here to guide you through them. Let's explore the five key compliance challenges you might face and, more importantly, how to conquer them.

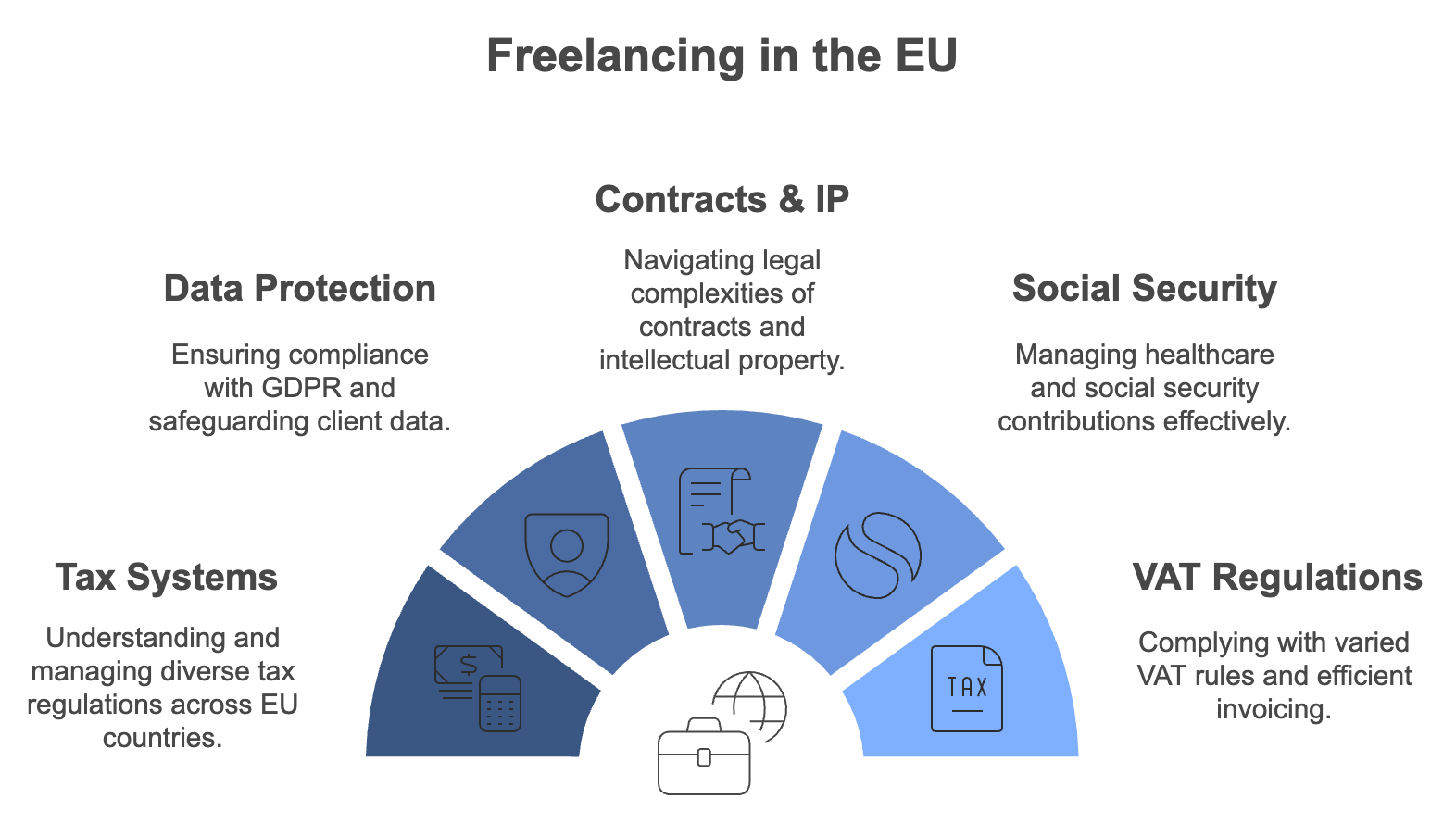

Navigating Different Tax Systems

The Challenge: One of the most daunting aspects of freelancing in the EU is dealing with various tax systems. Each country has its own rules, and if you're working across borders, things can get complicated quickly.

The Solution:

- Educate yourself on local tax laws in the countries where you operate.

- Consider using financial management tools like X-Ledger to keep track of your income and expenses across different jurisdictions.

- Don't hesitate to consult with tax professionals who specialize in international freelancing. It's an investment that can save you money and stress in the long run.

Data Protection and GDPR Compliance

The Challenge: The General Data Protection Regulation (GDPR) applies to freelancers too. Mishandling client data can lead to severe penalties.

The Solution:

- Implement strong data protection measures in your workflow.

- Create clear privacy policies for your freelance business.

- Conduct regular GDPR audits to ensure you're up to date with the latest requirements.

- Consider using secure, GDPR-compliant tools for client communication and data storage.

Contract and Intellectual Property Rights

The Challenge: Working across borders means dealing with different legal systems, which can complicate contracts and intellectual property (IP) protection.

The Solution:

- Use standardized contract templates that cover key aspects of your work and IP rights.

- Take time to understand IP laws in the different EU countries where you operate.

- Consider legal support services like X-Compliance to ensure your contracts are watertight and your IP is protected across borders.

Social Security and Healthcare Contributions

The Challenge: Social security systems vary across the EU, and ensuring proper healthcare coverage can be tricky for freelancers.

The Solution:

- Research the A1 form, which certifies which country's social security legislation applies to you.

- Explore private healthcare options that cater to freelancers and digital nomads.

- Stay informed about bilateral agreements between EU countries that might affect your social security status.

- Consider setting aside a portion of your income for healthcare and retirement savings.

VAT Regulations and Invoicing

The Challenge: Value Added Tax (VAT) regulations can be complex, especially when dealing with clients in different EU countries.

The Solution:

- Understand VAT thresholds and registration requirements in the countries where you operate.

- Use the VAT MOSS (Mini One Stop Shop) system when applicable to simplify VAT payments on digital services.

- Implement reliable invoicing and bookkeeping systems. Tools like X-Ledger can be invaluable in managing VAT across different jurisdictions.

- Regularly review and update your VAT status as your business grows.

Conclusion:

Navigating compliance as a freelancer in the EU may seem overwhelming, but with the right approach and tools, it's entirely manageable. By staying informed, using appropriate financial and legal tools, and seeking professional help when needed, you can turn these challenges into opportunities for growth and professionalism.

Remember, compliance isn't just about avoiding penalties – it's about building a sustainable, reputable business that clients can trust. Embrace these challenges as steps towards becoming a more successful and respected freelancer in the European market.

At Xtroverso, we're committed to supporting freelancers like you in navigating these complexities. Our suite of services, including X-Ledger for financial management and X-Compliance for legal support, are designed to take the stress out of compliance, allowing you to focus on what you do best – your work.

Ready to take your freelance business to the next level of compliance and professionalism? We're here to help. Contact us today for a free consultation and discover how we can support your journey as a freelancer in the EU.